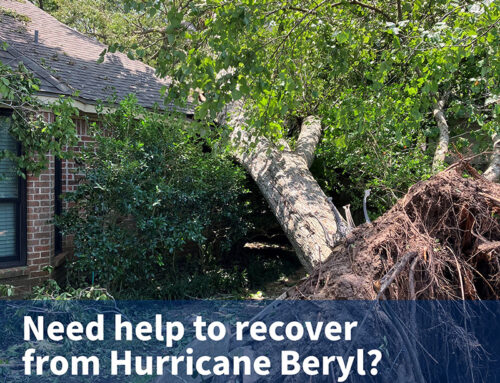

SACRAMENTO, Calif. – Low-interest federal disaster loans are now available to Texas businesses and residents as a result of President Biden’s major disaster declaration, U.S. Small Business Administration’s Administrator Isabella Casillas Guzman announced.

The declaration covers Harris, Liberty, Montgomery, Polk, San Jacinto, Trinity and Walker counties as a result of the severe storms, straight-line winds, tornadoes and flooding that began on April 26.

“SBA’s mission-driven team stands ready to help Texas’s small businesses and residents impacted by severe storms, straight-line winds, tornadoes and flooding,” said Administrator Guzman. “We’re committed to providing federal disaster loans swiftly and efficiently, with a customer-centric approach to help businesses and communities recover and rebuild.”

Businesses of all sizes and private nonprofit organizations may borrow up to $2 million to repair or replace damaged or destroyed real estate, machinery and equipment, inventory and other business assets. SBA can also lend additional funds to help with the cost of improvements to protect, prevent or minimize disaster damage from occurring in the future.

APEX Program Brief – Download the PDF

For small businesses, small agricultural cooperatives, small businesses engaged in aquaculture and most private nonprofit organizations of any size, SBA offers Economic Injury Disaster Loans to help meet working capital needs caused by the disaster. Economic injury assistance is available to businesses regardless of any property damage.

Disaster loans up to $500,000 are available to homeowners to repair or replace damaged or destroyed real estate. Homeowners and renters are eligible for up to $100,000 to repair or replace damaged or destroyed personal property, including personal vehicles.

Interest rates can be as low as 4 percent for businesses, 3.25 percent for private nonprofit organizations and 2.688 percent for homeowners and renters with terms up to 30 years. Loan amounts and terms are set by SBA and are based on each applicant’s financial condition.

Interest does not begin to accrue until 12 months from the date of the first disaster loan disbursement. SBA disaster loan repayment begins 12 months from the date of the first disbursement.

As soon as Federal-State Disaster Recovery Centers open throughout the affected area, SBA will provide one-on-one assistance to disaster loan applicants. Additional information and details on the location of disaster recovery centers is available by calling the SBA Customer Service Center at (800) 659-2955.

SBA Fact Sheet Disaster Loans (PDF)

About the U.S. Small Business Administration

The U.S. Small Business Administration helps power the American dream of business ownership. As the only go-to resource and voice for small businesses backed by the strength of the federal government, the SBA empowers entrepreneurs and small business owners with the resources and support they need to start, grow, expand their businesses, or recover from a declared disaster. It delivers services through an extensive network of SBA field offices and partnerships with public and private organizations. To learn more, visit www.sba.gov.